Onwards from Paris

Within industry and society there is an increased discussion in and around the term carbon footprint, in part driven by societal changes, and in others regulatory changes. Since the Paris agreement was drafted in 2015 and came into effect in 2016, countries have been looking at ways to reduce their greenhouse gas emissions (GHG). The Paris Agreement's long-term temperature goal is to keep the rise in mean global temperature to well below 2 °C (3.6 °F) above pre-industrial levels, and preferably to limit the increase to 1.5 °C (2.7 °F), recognising that this would substantially reduce the effects of climate change. The interchangeability of the terms GHG emissions and carbon emissions is in part due to the agreed reporting reference for combined GHG emission being CO2 -equivalent or CO2e for short. Carbon dioxide is the largest and most commonly known contributor to GHG emissions due to the large scale burning of fossil fuels.

Nationally determined contributions & the European Union

Countries determine themselves what contributions they should make to achieve the aims of the Paris treaty. As such, these plans are called nationally determined contributions (NDCs), but it is the targets and controls set by large countries and trading blocks that create drivers for international emission reporting and reduction. One of the most ambitious of these drivers was set out by the EU in its Green Deal. The European Green Deal is a roadmap to realign Europe’s economy with the trajectory to net-zero, help implement the Paris Agreement and build a more sustainable and fairer society. Developed by the European Commission in late 2019, it provides interim targets for the 2050 net-zero ambition with a commitment to reduce CO2 emissions by 55% by 2030.

With that commitment however comes challenges, the first being, 55% of what? The EU’s Emissions Trading Scheme covers an estimated 45% of the EU’s GHG emissions and limits greenhouse gas emissions from more than 11,000 installations, such as power stations and larger industrial plants (for example, factories that produce cement, lime and chemicals). To align the ambitious targets with actual reductions, the starting point is to have more accurate and complete emissions figures – that entails more companies filing audited emissions figures and the scope of reporting to be enhanced to cover all material emissions.

To encompass these requirements, sitting below the EU Green Deal are two sets of directives and regulations that will govern the improved emissions reporting that are being introduced through 2023 - the Carbon Border Adjustment Mechanism and the Corporate Social Reporting Directive.

The EU ETS & CBAM

The widening of the scope of the ETS from the original sectors such as power and heat generation, energy-intensive industrial sectors and aviation within Europe to include shipping, is taking place in parallel to the Commission proposing to apply emissions trading in other sectors through a separate new system, run in a similar way to the current ETS to incentivise the transition to cleaner road transport and heating fuels through a carbon price.

The Commission is proposing that emissions from the current EU ETS sectors (including the extension to the maritime sector) be reduced by 61% by 2030, compared to 2005 levels. This in turn will force European manufacturers to either purchase verified offsets or introduce cleaner manufacturing methods. To prevent “carbon leakage”, whereby energy intensive manufacturing is moved to countries without a carbon tariff, the EU is introducing the Carbon Border Adjustment Mechanism (CBAM).

The CBAM was originally planned to come into force in 2026 after a three-year transition, however current proposals have this time frame shortened to a 2025 introduction. The implementation of this mechanism is timed to coincide with the phasing out of free allowances under the EU ETS, meaning that EU emitters would be forced to truly reduce or offset emissions, since moving production elsewhere would not spare them from the carbon price.

Product groups included in the scope of CBAM

Starting 1st October 2023, CBAM will initially apply to EU imports of iron and steel, aluminium, electricity, certain fertilisers, cement and hydrogen, as well as certain precursors (i.e. cathode active materials) and a limited number of downstream products such as screws and bolts. There is no materiality threshold on these items and the emissions would need to be verified by a third-party independent verifier. For example, if a Middle East producer exports 50 tons of fertilisers or steel to the EU, the producer would have to comply with CBAM requirements.

It is expected that by 2030, the scheme will extend to all product groups covered by EU ETS or to the list of products with a risk of carbon leakage (i.e. crude petroleum and petroleum products, inorganic basic chemicals, industrial gases, synthetic rubber, non-ferrous metals and others), although presently there are no plans for the CBAM scope to be extended to LNG or natural gas.

The EU CSRD & ESRS

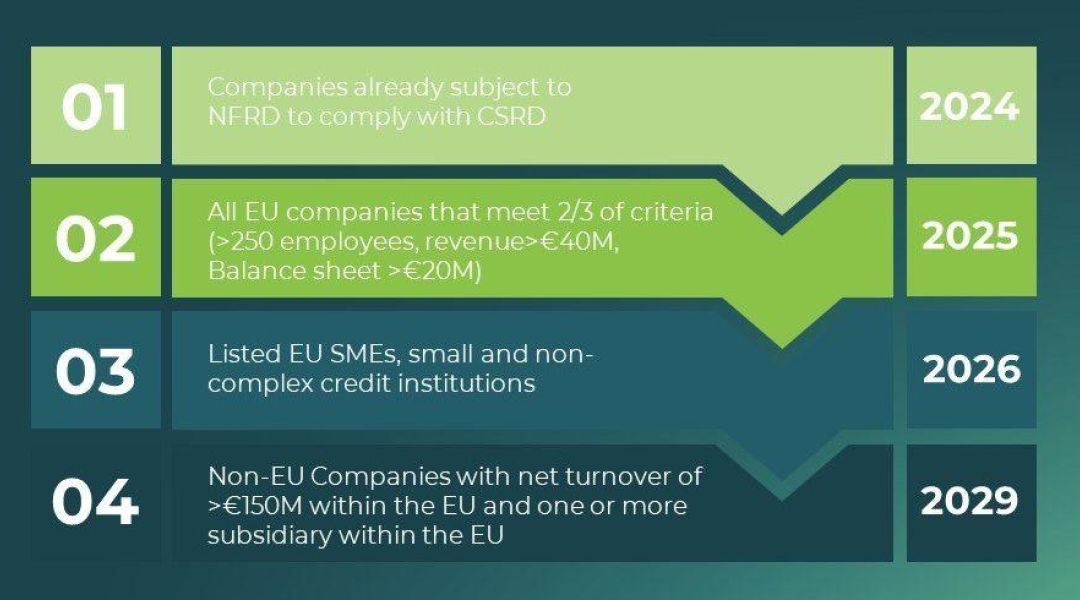

This new Corporate Sustainability Reporting Directive (CSRD) was proposed by the European Commission on 21st April 2021, with an aim to increase transparency on corporate performance in terms of sustainability. The CSRD replaces the previous Non-Financial Reporting Directive (NFRD) and brings about a significant scope change in which companies need to report these disclosures and to which standards they need to report. The CSRD is being introduced in four stages from 2024 through to 2029.

The effect of the move from NFRD to CSRD will raise the number of companies covered by the scheme from 11,000 to over 50,000. It will also introduce the new European Sustainability Reporting Standards (ESRD) which will be published in summer 2023 with the draft standards indicating some of the following changes from NFRD:

- Introduction of double materiality for sustainability (financial and environmental impacts)

- Entire value chain to be considered – scope 3 emissions mandatory

- Mandatory third party assurance – initially limited but moving to reasonable assurance with time

How does this affect business?

The EU Green Deal introduces nine policy areas, however the twin measures being developed on climate change will impact industry globally. Products produced internationally then sold to buyers within the EU will increasingly be covered either directly by the CBAM, or at home as those manufacturing countries introduce their own equivalent or compatible carbon tax systems. The scope of what is reported and by whom is pushed down from major emitters to smaller key links in the supply chain as scope 3 emission reporting becomes mandatory. These measures increase the complexity of the emissions reporting and drives a more complete carbon footprint determination whilst at the same time scrutiny on those same figures is increased as mandatory external audit is introduced.

So, what does all this effort deliver? It delivers a more reliable emission figure upon which to tackle emissions reduction, it provides an opportunity for organisations to use the information to drive efficiencies rather than a dusty report produced annually, and it will drive innovation in areas emission reduction.

Related Services