Background to the EU CBAM

The CBAM was devised to prevent carbon leakage, which first requires an understanding of what is meant by “carbon leakage”.

Carbon leakage refers to a situation in which efforts by one country or region to reduce greenhouse gas emissions through stringent climate policies result in increased emissions in another area that lacks such policies. This phenomenon is particularly associated with trade embodied emissions, where emissions associated with the production of goods are factored into international trade.

When a country adopts ambitious climate policies, industries within that country may face higher compliance costs related to carbon pricing or other regulations. To remain competitive and avoid cost disadvantages, some industries may relocate to regions with less stringent climate policies where they can operate with lower compliance costs. This relocation can lead to an increase in emissions in the region with weaker regulations, offsetting the emissions reductions achieved by the country with ambitious climate policies.

In practice, this can be seen as heavy industry, such as steel and petrochemicals moving production from Europe to Asia.

How will the CBAM work?

The CBAM works as a tax or duty to be payable on imports into the EU that meet certain criteria thresholds and is based upon the product’s embodied or embedded carbon emissions - the emissions associated with the manufacture of the product. Its aims are as follows:

1. Fair pricing for carbon emissions: The CBAM seeks to ensure that the carbon emissions associated with the production of certain goods are priced fairly. This involves calculating the carbon footprint of imported goods and charging a carbon price equivalent to that paid by domestic producers in the EU.

2. Encouraging cleaner industrial production: The primary goal of the CBAM is to encourage cleaner industrial production both within the EU and in non-EU countries. By imposing a carbon price on imports, the mechanism aims to create an incentive for producers to adopt more sustainable and low-carbon production methods.

3. Alignment with EU Emissions Trading System (ETS): The introduction of the CBAM is aligned with the phase-out of free allowances under the EU Emissions Trading System (ETS). The ETS is a cap-and-trade system that puts a limit on the total amount of greenhouse gas emissions that can be emitted by covered entities. The CBAM complements the ETS by addressing emissions associated with imported goods.

4. Compatibility with WTO rules: The EU has designed the CBAM in a way that is compatible with the rules of the World Trade Organization (WTO). This is to ensure that the mechanism does not violate international trade regulations.

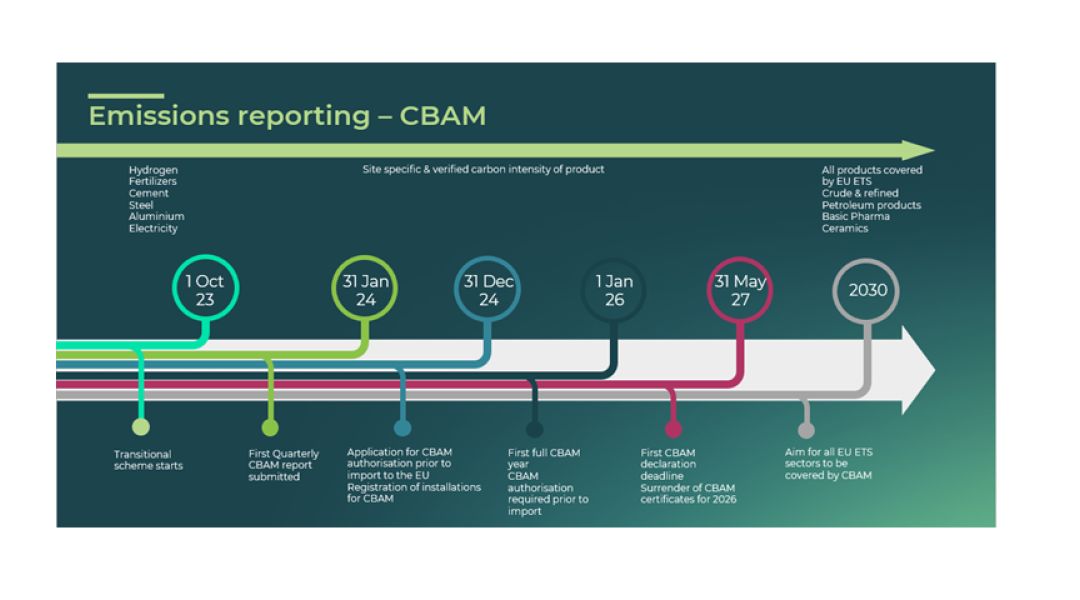

Once the permanent system enters into force on 1st January 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year along with their embedded GHG emissions. They will then surrender the corresponding number of CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted. The phasing-out of free allocation under the EU ETS will take place in parallel with the phasing-in of CBAM in the period 2026-2034.

Which goods are affected?

In the initial phase of the CBAM the following goods have been selected, with an intention that all products covered by the ETS scheme are incorporated in the CBAM by the end of the decade.

- Cement

- Fertilisers

- Iron/Steel

- Aluminium

- Hydrogen

- Electricity

The EU CBAM timeline

Determining the embodied carbon of a product

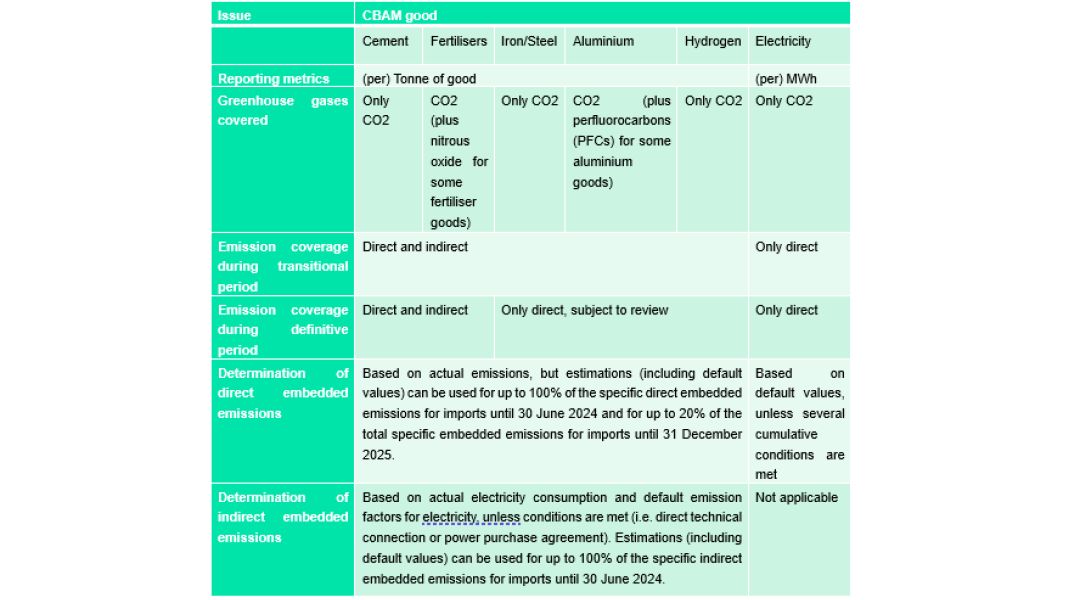

The following table provides an overview of the specific emissions and greenhouse gases covered and how direct and indirect emissions are determined for each sector falling under the CBAM scope.

The Implementing Regulation on reporting requirements and methodology provides for some flexibility when it comes to the values used to calculate embedded emissions on imports during the transitional phase.

Until the end of 2024, companies will have the choice of reporting in three ways: (a) full reporting according to the new methodology (EU method); (b) reporting based on an equivalent method (three options); and (c) reporting based on default reference values (only until July 2024).

As of 1st January 2025, only the EU method will be accepted and estimates (including default values) can only be used for complex goods if these estimations represent less than 20% of the total embedded emissions.

From 2026, the calculation of the embodied carbon not only needs to follow the EU’s defined methodology and boundaries but must also have been externally verified at a specific plant level.

The UK CBAM and EU CBAM interaction

The CBAM has been designed to ensure that imported goods will get equal treatment with EU products. This is covered by linking the CBAM price to the EU ETS scheme. In the case of alternative countries and regions (and countries classified as a third country) that have their own ETS scheme, the effective carbon prices paid outside the EU will be deducted from the adjustment to avoid a double price.

The practical effect of this is that the price paid for UK ETS would be deducted from the CBAM certificate price required.

The UK and EU ETS schemes were closely aligned until early 2023 when they began to diverge with the UK ETS being lower cost. The impact at present would be the requirement for importers of UK goods into the EU being required to pay that current differential.

Indeed, the UK government is currently examining the definitions for the emission boundaries that its own CBAM should cover. However, any significant divergence from the EU boundary definition has the potential to lead to differing embodied carbon figures requiring to be declared for goods imported into the UK versus the EU.

Failure to report

Although payment for CBAM certificates only comes into place from January 2026, penalties for non-disclosure apply from January 31st 2024 for goods imported from 1st October 2023, with fines ranging between €10 and 50 per tonne of unreported emissions.

The penalties apply where:

- The reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report

or

- Where the CBAM report is incorrect or incomplete, and the reporting declarant has not taken the necessary steps to correct the CBAM report after the competent authority initiated the correction procedure.

Next steps & impacts

Customs authorities will inform customs declarants of their obligation to report information during the transitional period for the EU CBAM, and it is expected the UK will align with this. This puts the onus on the importer, or the buyer to complete the declarations. However, the tariff associated with this import has a direct effect on the competitiveness of the manufacturer.

For manufacturers, staying and competitive will require:

- Calculation of embodied carbon per tonne of goods

- Certification of the embodied carbon figures from 2026

- Carbon reduction planning to stay competitive (the EU aim is incentivise carbon reduction)

- Understanding of lifecycle emissions as product and emission boundaries widen and are included in the CBAM scope

In summary

As always with trade, there are at least two parties involved, and the international trade of goods now has an added complexity into the EU. For importers, they could potentially see import tariffs applied on goods they have already contracted to import in areas such as offshore wind turbine foundations and ship building pushing up their costs. Whilst that may have an impact on existing contracts, future contracts will need to ensure the carbon intensity of goods is part of the tender appraisal process. For manufacturers globally (including the UK), competitiveness can be achieved by reducing their carbon footprint as the CBAM is designed to do, but this starts with understanding the true carbon footprint of their goods.

Related Services